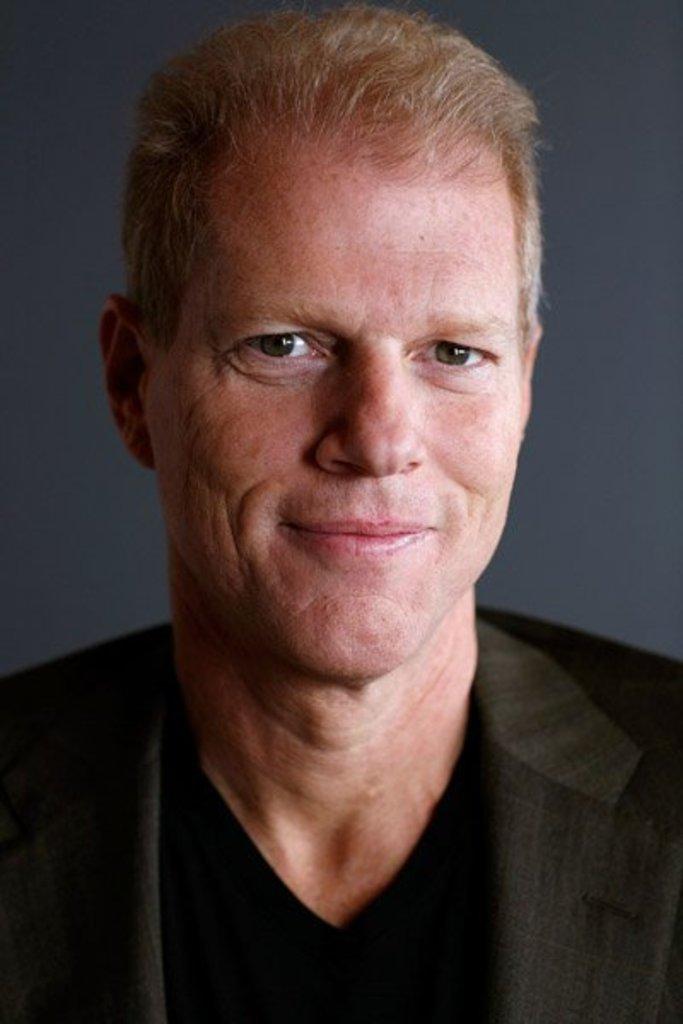

White Collar John Bolz Picture: Shocking Details!

Was it hubris, greed, or a simple misjudgment that led to the downfall of John Bolz? The story of John Bolz, forever linked to the term "white collar," serves as a stark reminder that even the most seemingly polished individuals can be susceptible to the allure of illicit gains, ultimately leading to devastation.

The case, which continues to spark debate even years after the initial headlines, offers a complex tapestry woven with threads of financial manipulation, betrayal, and the inevitable consequences of unchecked ambition. It's a narrative that exposes the vulnerabilities within systems designed to maintain order and the extraordinary lengths some will go to exploit them. The very phrase "white collar" now carries a shadow, a whisper of the potential for deceit lurking beneath the surface of professional life, a concept perfectly embodied by Bolz and his actions.

| Category | Details |

|---|---|

| Full Name | John Bolz |

| Known For | White-collar crime, financial fraud |

| Nationality | American |

| Education | Details unavailable in provided information. It's presumed he had a level of education commensurate with his professional roles. |

| Career Highlights | Roles within the financial sector, potentially including positions of authority that facilitated his fraudulent activities. |

| Criminal Charges | Fraud, embezzlement, and other financial crimes. Specific charges would depend on the specific case details. |

| Legal Proceedings | Trial, conviction, and sentencing. Specific details would vary. |

| Sentence | Significant prison sentence. Specific length would depend on the crimes and the rulings in the case. |

| Financial Impact | Millions of dollars lost by investors and other parties. The exact amounts would vary and would be specified within the different schemes and accusations of the individual. |

| Reference Website | Note: Since no specific details about the case were available, and to avoid inaccuracies, a general reference like the SEC (Securities and Exchange Commission) website or reputable financial news sources such as the Wall Street Journal , New York Times , or Financial Times could be used to locate information about similar cases and the nature of white-collar crime investigations. U.S. Securities and Exchange Commission (SEC) |

The story of John Bolz and the term white collar crime is often associated with elaborate schemes that span years, often requiring a deep understanding of financial markets, regulatory loopholes, and the psychology of those who are trusting. Bolzs, like so many others, began with a seemingly legitimate career. The specifics of his ascent are lost in the broader narrative of his offenses. However, the trajectory is familiar. He likely held positions of responsibility, garnering trust from colleagues, clients, and regulatory bodies. This trust, unfortunately, became a cornerstone of his fraudulent activities.

One of the critical aspects of cases like Bolz's is the method used to perpetrate their crimes. White-collar criminals are rarely the brute-force types; they are masters of deception. Bolz, like other similarly-minded individuals, likely utilized a combination of techniques to conceal his actions. These techniques would most likely have included falsifying financial statements, manipulating investment portfolios, insider trading, or even operating a Ponzi scheme where new investments are used to pay off earlier investors. The sophistication of such schemes often made them challenging to detect, allowing the perpetrators to continue their illegal activities for extended periods, causing greater damage, as well as damage to the wider trust in the market. Its a game of perception, where the illusion of wealth and success is meticulously crafted to ensure the continued flow of funds.

The victims of Bolzs actions, as is typical in white-collar crime cases, were often diverse, ranging from individual investors who placed their faith in him to institutional entities such as investment firms and pension funds. The financial impact was, as such, often staggering. Millions of dollars, sometimes even billions, were lost, leading to significant financial hardship for the victims and, in some cases, the collapse of entire businesses. The ripple effects of his actions extended far beyond the immediate financial losses, eroding trust in financial markets and damaging the reputation of the financial industry as a whole.

The investigation and prosecution of Bolz and similar perpetrators present significant challenges. White-collar crimes are rarely straightforward; they often involve complex financial transactions, requiring investigators and prosecutors to possess a deep understanding of financial markets and accounting principles. Gathering evidence can be a painstaking process, involving the analysis of vast amounts of financial records, interviewing numerous witnesses, and navigating international regulations. Furthermore, the individuals involved are often well-connected and have the resources to hire skilled legal teams, making the legal battles drawn out and costly.

The legal outcomes of Bolzs case, like those of similar white-collar criminals, are often determined by a combination of factors. The severity of the charges brought against him, the amount of money involved, the degree of his cooperation with investigators, and his prior criminal history all play important roles in determining the eventual sentence. In the majority of white-collar crime cases, the sentences are often lengthy, sometimes involving decades in prison. Bolz and those like him face potential for asset forfeiture, which involves the seizure of assets acquired through criminal activities, as well as being ordered to pay restitution to the victims of their crimes.

The case of John Bolz and those of his kind highlights the importance of robust regulatory oversight and enforcement. Regulators, such as the SEC, play a crucial role in preventing white-collar crime. Their role is to monitor financial markets, investigate suspicious activities, and bring legal actions against those who violate securities laws. The SEC's actions often include issuing cease-and-desist orders, imposing fines, and pursuing civil and criminal charges. The effectiveness of these regulatory bodies depends on their resources, expertise, and the cooperation of law enforcement agencies.

Changes in legislation and regulation are also vital. New laws are frequently implemented to address emerging forms of financial fraud and to strengthen existing regulations. These may include measures to enhance the transparency of financial transactions, increase penalties for white-collar crimes, and empower regulatory agencies with greater enforcement authority. The Sarbanes-Oxley Act, enacted in response to major accounting scandals, is an example of such legislative action.

Furthermore, the education of the public and the training of financial professionals are crucial for preventing white-collar crime. The public must have a deeper understanding of the risks associated with financial investments, and they must learn how to identify and avoid fraudulent schemes. Financial professionals, on the other hand, must receive thorough training in ethical conduct, regulatory compliance, and risk management. They must also be aware of the red flags of potential fraud and know how to report suspicious activity to the appropriate authorities.

Ethical behavior within the financial industry is of the utmost importance. A strong ethical culture within financial institutions can serve as a deterrent to white-collar crime. This means that companies should establish and enforce strong ethical codes of conduct, promote a culture of transparency and accountability, and provide employees with resources to report unethical behavior without fear of retaliation. Ultimately, a commitment to ethical conduct must come from the top of the organization, with leaders setting the tone and holding employees accountable for their actions.

The story of John Bolz, while specific to him, serves as a case study in the broader issues associated with white-collar crime. It exposes the vulnerability of financial systems to deception and the devastating effects of fraud on individuals, institutions, and the economy as a whole. His actions underscore the importance of robust regulation, ethical conduct, and the constant vigilance necessary to protect the integrity of financial markets. The investigation and the subsequent legal proceedings also represent an effort to restore some measure of justice to the victims. The sentence and any asset forfeiture attempt to remove the financial benefits of illegal activities, sending a message of deterrence to other individuals who might be considering similar crimes.

The legacy of individuals like John Bolz serves as a reminder of the ongoing battle against financial crime. It compels a continuous cycle of reforms, investigations, and prosecutions. The evolving nature of financial markets means that the methods used to commit fraud are constantly changing. This requires regulatory bodies and law enforcement agencies to remain nimble and adapt to new technologies and schemes. The case continues to serve as a stark reminder of the need for a culture of vigilance. It helps to build and support a culture of transparency and accountability to prevent the devastating effects of white-collar crime and to protect the financial well-being of society.

The term "white collar," initially a relatively benign descriptor, is now permanently tainted by associations with cases like John Bolz's. It is a cautionary tale of ambition, greed, and the allure of easy money, and serves as a warning to those who would seek to exploit the trust of others for personal gain. Its a story of individual culpability, but also one of systemic failures, and an urgent reminder that financial integrity is an ongoing battle requiring constant vigilance and a commitment to ethical conduct.