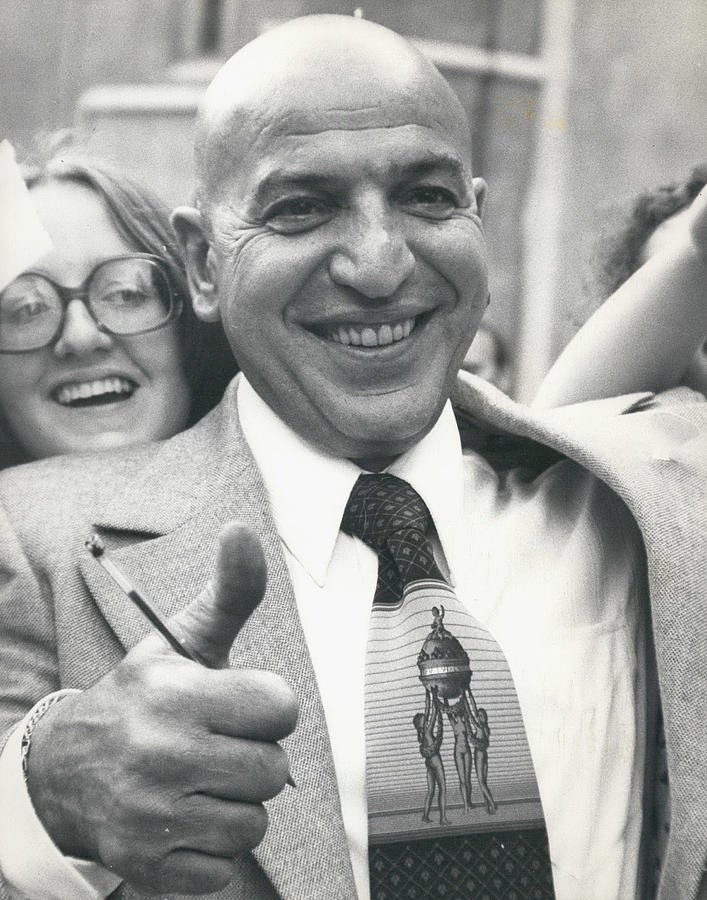

Tax Evasion Scandal: Telly Savalas' Case Explained

Did the charming, lollipop-sucking Lieutenant Theo Kojak, a figure who graced television screens and captivated audiences with his gritty portrayal of a New York City detective, harbor a secret that contradicted his on-screen persona? The truth is, Telly Savalas, the actor behind the iconic character, was embroiled in a complex and controversial tax evasion case that cast a long shadow over his career and revealed a side of the star far removed from the benevolent image he cultivated. The details surrounding this case offer a glimpse into the financial realities of Hollywood and the lengths some individuals might go to protect their fortunes.

The story begins not with a dramatic arrest or a courtroom showdown, but with the intricate world of finance and the pursuit of minimizing tax obligations. For Telly Savalas, whose fame and fortune had blossomed in the entertainment industry, managing his finances became an increasingly complex endeavor. While his on-screen persona exuded a sense of justice, the actor faced accusations of engaging in practices that, if proven true, would be in direct conflict with the law. The allegations included the underreporting of income and the utilization of questionable financial schemes designed to reduce his tax burden. This led to an investigation that would eventually bring Savalas under the scrutiny of the Internal Revenue Service (IRS) and plunge him into a legal battle that lasted for years.

| Category | Details |

|---|---|

| Full Name | Aristotelis "Telly" Savalas |

| Born | January 21, 1922, Garden City, New York, USA |

| Died | January 22, 1994, Los Angeles, California, USA |

| Nationality | American |

| Occupation | Actor, Singer, Director |

| Known For | Playing Lieutenant Theo Kojak in the television series "Kojak" |

| Spouse(s) |

|

| Children |

|

| Education | Columbia University (BA in Psychology) |

| Filmography Highlights |

|

| Music Career |

|

| Political Views | Reportedly a Republican |

| Link to Authentic Website | IMDb - Telly Savalas |

The IRS investigation, meticulously conducted, scrutinized Savalas' financial records, tracing the flow of money and examining the deductions he claimed. Agents dug deep, analyzing the details of his business ventures, his personal expenses, and the tax strategies employed by his financial advisors. The process was lengthy and complex, involving the examination of documents and the interviewing of individuals connected to Savalas' financial affairs. The IRS sought to determine the accuracy of his tax returns and whether he had intentionally violated tax laws.

One of the core issues at the heart of the case involved allegations of underreported income. The IRS alleged that Savalas had failed to properly account for all the income he received from his acting career, business ventures, and various other sources. This meant that the taxes he paid were potentially lower than they should have been. The discrepancies, if proven, could have resulted in a substantial tax debt, including penalties and interest.

Beyond the underreporting of income, the investigation also delved into potentially questionable financial schemes. These schemes, often complex and designed to exploit loopholes in the tax code, were allegedly used to minimize Savalas' tax obligations. While details remain somewhat guarded due to privacy concerns and legal proceedings, it's clear that the IRS scrutinized these strategies, looking for evidence of tax avoidance or, potentially, outright evasion.

The implications of the tax evasion case extended far beyond the immediate financial repercussions. The allegations against Savalas carried significant consequences for his reputation. His carefully cultivated image, portraying a man of integrity, was challenged. The public's perception of him began to shift, and the case became a topic of discussion and speculation in the media. While the legal proceedings played out, the court of public opinion rendered its own verdict.

The legal proceedings themselves were a complicated affair. Savalas, represented by legal counsel, fought to defend himself against the IRS's claims. The case likely involved a series of negotiations, legal arguments, and potentially, a courtroom trial. The specifics, including the exact amount of taxes owed, the nature of the alleged schemes, and the final resolution of the case, are elements that remain subject to the details of the proceedings, including potential confidential settlements. What is clear is that the process took years, and the outcome carried significant consequences for the actor.

The legacy of the Telly Savalas tax evasion case is complex. It serves as a reminder that even beloved celebrities are not immune to the complexities of financial regulation and the scrutiny of tax authorities. The case also raises questions about the ethics of tax avoidance and the responsibility of individuals to comply with tax laws. It serves as a caution about the potential pitfalls of managing vast wealth and the importance of seeking sound financial advice.

The case also provides a glimpse into the realities of Hollywood finances. Actors and other entertainment professionals often have complex financial lives, with income coming from various sources and a need to manage their earnings effectively. The Savalas case highlights the importance of proper financial planning, accurate record-keeping, and compliance with tax laws. It underscored that even the brightest stars can find themselves in trouble if their financial affairs are not managed responsibly.

The media's coverage of the case was extensive, with news outlets and entertainment publications covering the developments. The public, already fascinated by the life of a celebrity, became even more intrigued by the legal and financial struggles faced by Savalas. The details of the case were dissected and debated, with the public often having a range of opinions regarding the actor's guilt or innocence. The media played a significant role in shaping the public's perception of the case.

Despite the controversy, the case didn't completely diminish Savalas' fame or public appeal. He continued to work in film and television, and his popularity remained relatively stable. However, the shadow of the tax evasion case lingered in the background, serving as a reminder of the legal and ethical issues that can arise in the entertainment industry. It serves as a cautionary tale for other celebrities, financial advisors, and anyone involved in the complex world of wealth management.

The ultimate resolution of the Telly Savalas tax evasion case, including any final settlement or judgments, provides valuable insight into the enforcement of tax laws and the consequences of financial misconduct. While some details might remain confidential, the case leaves an indelible mark on the legacy of the actor, revealing a complex side that challenged the public image he carefully crafted. It is a reminder that even those who portray justice on screen may face challenges from the complexities of their financial affairs in real life. The examination of his case continues to offer lessons in financial responsibility, and the potential pitfalls that can result when these responsibilities are ignored.

The repercussions of the case also extend to the financial professionals who advised Savalas. The investigation would have likely looked at the role of accountants, lawyers, and financial planners, assessing their responsibilities in relation to the actor's financial strategies. These advisors face their own potential legal and ethical obligations. The details of their involvement, and any resulting consequences, also constitute part of the wider scope of the case.

While the details remain etched into legal records, the narrative of Telly Savalas' tax evasion case highlights how the pursuit of financial gain, and the complex nature of tax laws, can ensnare even the most recognizable figures. It offers a glimpse into the intersection of celebrity, wealth, and financial compliance. It's a testament to the enduring impact of legal and ethical matters that will be remembered for decades to come.